8. Book of Accounts & Auditing

when your freelancing business flourishes

Everyone wants to thrive in his/her business, and freelancers are no exception. We continue to be in operation with the vision of “making it big”. So, it is only fair to equip ourselves with the knowledge of “What to do”…. “When we actually get there”.

I believe that unlike some, most of you (like me) have very limited knowledge of financial jargons. Yet, this is no excuse for not-educating oneself. Let us get started.. now that it involves “money-matters”…

A. Book of Accounts

Definition: “Books or books of account includes ledgers, day-books, cash books, account-books and other books, whether kept in the written form or as print-outs of data stored in floppy, disc, tape or any other form of electro-magnetic data storage device”. This is an inclusive definition.” – Source : Taxguru

In other words, you need to maintain records of income, expenses, receipts, bills for all transactions exceeding ₹ 50/- Be informed (forewarned) that you are required to preserve these books for at least 6yrs.

Gross Receipts (Definition):

Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses.

B. Auditing (& of course, Auditor)

The book “An Introduction to Indian Government Accounts And Audit” [page 14, para 1.9] issued by the Comptroller and Auditor General of India, defines audit as

“An Instrument Of Financial Control. It acts as a safeguard on behalf of the proprietor (whether an individual or group of persons) against extravagance, carelessness or fraud on the part of the proprietor’s agents or servants in the realization and utilization of the money or other assets and it ensures on the proprietor’s behalf that the accounts maintained truly represent facts and that the expenditure has been incurred with due regularity and propriety. The agency employed for this purpose is called an auditor.”

In simpler terms, auditing means, to check the accuracy of the financial statements (income , expenses, profit&loss) and detect any errors or fraudulent transactions, which should be duly recorded and reported.

Nirmal Says,

Requirement of Maintenance of Accounts

“ If your Gross Receipts from Freelancing / any Other Business / Professional exceed ₹10 lakhs or income exceeds ₹1,20,000/- in the Financial Year then you are liable to maintain books of accounts”

Requirement of Audit

“If your Gross Receipts from profession exceed ₹25 lakhs or from Business exceeds ₹1 crore in a financial year, you are liable to get your accounts audited by a Chartered Accountant.”

Ref : Simpletaxindia

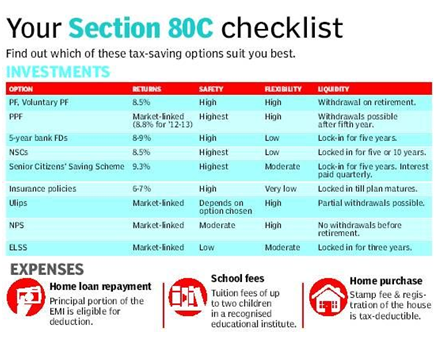

“Income from freelancing is then a part of Gross Total Income, just like your Income from Salary, or Income from House Property or Other Sources (Interest incomes, etc). All deduction which are available u/s 80C such as PPF, LIP , etc to name a few, are available from Gross Total Income.

When the income includes ‘Income From Business / Profession’, then applicable Income Tax Return Form is either ITR 4S [Income from Business is assessed a Presumptive Rates] (OR) ITR 4 [For all Business(es) including Audited]”,

See http://canirmalg.wordpress.com/disclaimer/ disclaiming liability on behalf of the author / persons giving inputs and making reviews, etc.

Our Income Tax Department has put forth clean and simple how-to on payment of Income Tax,

Our Income Tax Department has put forth clean and simple how-to on payment of Income Tax,

Question

Question