Image Credit :http://www.webstarwest.com/Fairies/

The outcome of social media has opened a door of opportunities to everyone. It has given people an ability to communicate, interact, access information, make new friends/contacts and a wide range of things that were not possible with other media. Be it the use of Social Networking using Facebook/Hi5 or social photo/video sharing using YouTube/Flickr. And what more- Social Bookmarking, Social News and Wikis…The connectivity social media has got to the lives of everyone cannot be neglected.

It’s seen in many data surveys that women make it as the maximum users of social media than men. Women can be seen using it as a major source of entertainment and a source of news, content and conversations. It has given them a chance to get connected to the world easily. Women, as we know are good net-workers naturally, and with social media, they are forming more and more women networks and running them successfully.

Anusha Jha Rohom, Freelance Writer/Consultant, Bangalore, says,

“Social media has empowered women to network and connect with people relevant to their profession/business. Not just professionals, even amateurs are leveraging social media to reach out to a larger audience.I don’t think social media offers any particular advantage to women exclusively… both the sexes benefit equally from social media.”

There are many networks available online to connect women like, http://worldpulse.com/ , http://www.womenforwomen.org/, http://socialmediawomen.wordpress.com/

Also many groups are seen on Facebook/twitter like Fleximoms, mycity4kids, Sheroesindia, etc., to help women share their experiences, views, or find jobs. Social media is a great tool for young mothers too.

Deepa Govind says,

“We women have a natural tendency to connect and engage in small talk, have a reputation of being gossip mongers, and very good at that. May be, it is in our genetic makeup and Social Media seems to be the perfect platform for gossip. But it seems we have found a way to convert our vice into virtue.” She adds, “Woman mark her clients after observing a potential’s social media chatter. From here on, she would make attempts to small talk into the client’s needs, and pitch her services / business from a more strategic point of view. This way, she ensures that she is investing her time only on seemingly useful potentials, and not just blind calls.”

Women are specially seen making use of social media to start/expand the businesses. Be it a start-up business or an established one, women are seen advertising, blogging, etc. about it on the web.

Take example of women entrepreneurs like Pam Brossman Amazon #1 Best Selling Author or CEO of SheExperts.com making the right use of it. Or be it the organizing solutions provided by Alejandra at http://www.alejandra.tv/. They get a lot of turnover from their businesses; guess if it was not without social media.

Meet Jessie DSouza, Virtual Business Owner, Mangalore.

She uses social media to communicate and connect with potential clients. She adds,“I use social media to share knowledge and expertise. I have a facebook group, “Work From Home Divas India” where I guide the aspiring work from home moms to start their own businesses from home”.

Take example of Jenny Hogan, Tech-Savvy news anchor at KIRO 7 EyeWitness News in Seattle. (Reference: http://blog.hootsuite.com/social-media-jenni-hogan/, December 5, 2012 by Ulara Nakagawa). Over the past few years, she’s learned how to harness the power of social media and her own celebrity to promote a worthy cause. In 2010, Jenny debuted, “The KIRO 7 Mobile Tweetup with Jenny Hogan,” which broke new ground as a TV news program that fuses social media outreach with local causes. The show, which Jenny both produces and hosts, has been an overwhelming success, winning an Emmy and getting her nominated for a Shorty Award. Now into its third year, the mobile tweetups have generated more than 75,000 items for babies and 6 truckloads of toys for kids benefiting Toys For Tots. And the most recent summer tweetup rose over $11,000 in donations in just three hours, to help support early cancer detection research.

Many parents today have started freelancing for income. We can find many “Mommy Bloggers” today, who make a living off their blogs, write books and even speak at conferences. These mommy bloggers share interesting and informative stories about parenting and are also approachable and open to comments.

Jenny Hogan in an interview to Ulara Nakagawa also said

“I think women are more powerful than they think in social media. As a mother, I see other mothers multitasking, working full time, being CEO of their family and using technology to be more efficient. I think that we are the super users of technology being busy, working moms. Females, without even knowing it, are leaders in this area. Tech companies should let females be part of the discovery process rather than coming up with a product and saying ‘here’s how we think it’s going to be great for you.’ There are a lot of brilliant women out there and if tech companies just listen to what they’re saying, we could find some pretty cool jackpots that will help a lot of people in the future.”

To conclude, it’s seen that there is meaningful and impactful work being done by women using the social web. More and more women are finding their voice, confidence and careers online. Social media has given a safe place for women to learn, grow and aspire. Women have got freedom to define the scope of their life and achieve their full potential.

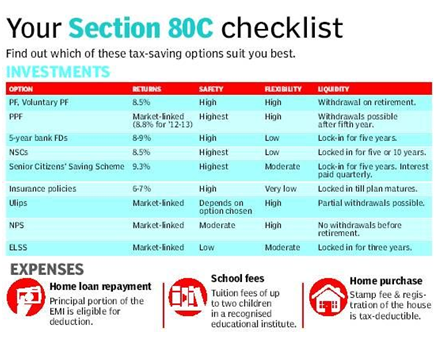

Well, Don’t we all dread the this time of the year, when every publication (print, online or otherwise) is flooded with write-ups (.. shout-outs..) on Income Tax planning, Income Tax savings, Income Tax computations, Income Tax Returns etc etc. It so seems, the universe wants us to explicitly remember that it is TAX-Time, and no escaping at it.

Well, Don’t we all dread the this time of the year, when every publication (print, online or otherwise) is flooded with write-ups (.. shout-outs..) on Income Tax planning, Income Tax savings, Income Tax computations, Income Tax Returns etc etc. It so seems, the universe wants us to explicitly remember that it is TAX-Time, and no escaping at it.

Our Income Tax Department has put forth clean and simple how-to on payment of Income Tax,

Our Income Tax Department has put forth clean and simple how-to on payment of Income Tax,

Question

Question