Picture this, you’ve mulled for more than a week and worked hard to build the project map before your client meeting. It’s a great app and it does everything your client said he wanted. In your head, this is ‘manna from heaven’ as far as your client’s problems are concerned. But you fail miserably to impress. You run short of words and the project never takes off. Sounds familiar?

Do not lose heart. Trust me, you’re not the only one struggling with business communication.

Business Communication is an art you need to master for entrepreneurial success and it can take a while to learn. As an entrepreneur, you’re needed to make solo decisions on a daily basis. Some will come easy and some will be hard. Effective communication is the only way to speed up your decision making and will help you jet to success.

Business Communication is an art you need to master for entrepreneurial success and it can take a while to learn. As an entrepreneur, you’re needed to make solo decisions on a daily basis. Some will come easy and some will be hard. Effective communication is the only way to speed up your decision making and will help you jet to success.

Here are 5 points that will help you scale-up your business communication.

1) Speak your client’s language

Remem

Remem ber your client and you don’t share the same expertise. That’s why he’s hired you right?

ber your client and you don’t share the same expertise. That’s why he’s hired you right?

You need to be precise and very careful with your choice of words. For example, if he’s hired you to design a website, make sure to communicate how you will bring his ideas to life. Speak to him in a language that he understands. Talk about the brand appeal, the visibility it will generate rather than throwing technical jargons that sound Latin and Greek to him.

But you need to bring in the technical stuff to present the complete idea. Wondering how to do that?

The key here is to LISTEN. Listen to your client while he talks. Use his words and in a clear concise manner interject the technical information only when necessary. You also bring in warmth to the communication when you repeat his words. He knows your listening.

2) Never Lie

When a requirement is being discussed never leave it hanging to maybe or I think so and never ever make a promise you can’t deliver. Leaders don’t lie. If you don’t deliver on your word, your breaking your client’s trust and tarnishing your credibility. Also, don’t hesitate to take the blame when things go wrong.

When a requirement is being discussed never leave it hanging to maybe or I think so and never ever make a promise you can’t deliver. Leaders don’t lie. If you don’t deliver on your word, your breaking your client’s trust and tarnishing your credibility. Also, don’t hesitate to take the blame when things go wrong.

3) Ownership

Most of us have had situations where we are not able to make it to important meetings and in grave scenarios, missed delivery deadlines. While you never want such a situation to arise, if it does take complete ownership of the situation and offer an alternative solution. Transparency in business communication is key to a long-term relationship.

4) Record conversations

Never depend on your memory to remember every conversation with your client. You want to record those video calls, save all the emails and send out minutes when you’ve had an e-meeting, in-person conversation or a teleconference with your client.

Be sure to highlight the points discussed so that either party doesn’t deviate from what was discussed. You don’t want to write an essay here. Keep it crisp and to the point. Here again, remember to choose the words your client understands.

5) Read, read and READ some more

A sure shot way to up your written and verbal communication is to read. It will broaden your mind, widen your vocabulary and boost your confidence. Most entrepreneurs devote a major chunk of their time to developing their business idea and often don’t have time to read. But the success of your business lies mostly in how well you can communicate your idea.

A sure shot way to up your written and verbal communication is to read. It will broaden your mind, widen your vocabulary and boost your confidence. Most entrepreneurs devote a major chunk of their time to developing their business idea and often don’t have time to read. But the success of your business lies mostly in how well you can communicate your idea.

Reading opens up doors you never knew existed and as entrepreneur you sure as heck want that. Pick up self-help books and business books as they always have the most articulate and precise words you can incorporate in your business communication.

Take out half an hour every day and soon it will be a habit. On that note have you read ‘The Power of Habit’ by Charles Duhigg? That’s a great read for an entrepreneur.

Now that the key points to effective communication are revealed to you, always remember that you’re trying to communicate your ideas not just to be understood by your client but more importantly, you don’t want to be misunderstood.

P.S. Need more insight to improve your Business Communication or help with a reading list? Subscribe to our updates and get exclusive access to connect with me or Deepa on our Facebook Homepreneur® Community.

#AskDeepa #AskMisha #BusinessCommunication

Not long ago, I

Not long ago, I

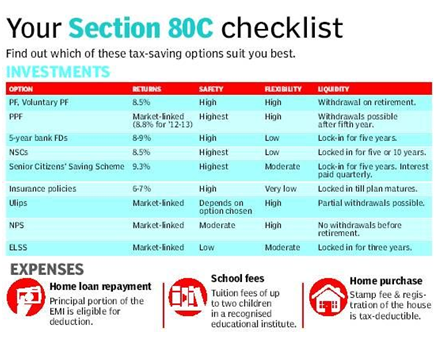

Well, Don’t we all dread the this time of the year, when every publication (print, online or otherwise) is flooded with write-ups (.. shout-outs..) on Income Tax planning, Income Tax savings, Income Tax computations, Income Tax Returns etc etc. It so seems, the universe wants us to explicitly remember that it is TAX-Time, and no escaping at it.

Well, Don’t we all dread the this time of the year, when every publication (print, online or otherwise) is flooded with write-ups (.. shout-outs..) on Income Tax planning, Income Tax savings, Income Tax computations, Income Tax Returns etc etc. It so seems, the universe wants us to explicitly remember that it is TAX-Time, and no escaping at it.